This election and the insanity of betting markets

If you were following the 2020 U.S. presidential election, you might remember the barrage of ”experts” offering predictions on the outcome of the election on every news network and in every newspaper. Every now and then somebody would come in and say:

What do these so-called experts know? Instead of listening to experts you should look at the probabilities implied by betting odds.

Up until this election, I used to be one of those people. I would say:

These odds must represent the best possible estimate, because otherwise you could make money by betting on the event.

Taken literally, this argument is of course wrong because you can make money in the betting markets. Or maybe you can’t, but someone else can. This topic, the difficulty of beating a market, is referred to as market efficiency. You may have heard this term in the context of stock markets, but it applies just as well to other markets, including betting markets[*].

First, a quick primer on market efficiency

A perfectly efficient market is a theoretical concept; a market where current prices perfectly reflect all available information. That means no trader will be able to gain an edge over other traders in the market: a trader who spends all their waking hours studying the market will have the same expected value as a monkey who throws darts at a newspaper.

In the real world no market is perfectly efficient. Some are more efficient, some are less. Let’s consider the stock and derivatives market as an example. We know that this market is not perfectly efficient, because some participants make outsized profits year after year for decades. Warren Buffet’s Berkshire Hathaway has outperformed the market since 1962. RenTec’s Medallion Fund has crushed the market since 1988. So we know that it’s possible to beat the stock market. But we also know that trading in the stock market occurs mostly between highly specialized professionals (or algorithms written by highly specialized professionals) who have devoted their lives to the market. If a layperson has a couple of hours to spare, can they reasonably expect to beat the professionals on the other side of those trades? Of course not[**].

We generally expect markets to become more efficient over time, as money shifts from bad traders to good traders. That means good traders will have more impact on stock prices (or betting odds), and bad traders will have less impact.

Should we expect betting markets to be similar to stock markets in efficiency? At least in the case of large markets, such as major sporting events or major political events, the answer is a resounding yes. The size of the market provides an incentive for smart people to dedicate time to figuring out probabilities of different outcomes. And the people who are good at predicting things should have vastly more money to bet than the people who are bad at predicting things. So you would expect Trump-Biden odds to be so efficient that a layperson wouldn’t be able to beat the market. And you would be wrong.

Nate Silver versus the betting markets

In the weeks leading up to the election, Joe Biden had a massive lead in the polls. Despite that, the betting markets were offering odds above 1.6 for Biden, implying Biden had less than 62% chance of winning. That’s weird, right? How much uncertainty could there possibly be so close to the election, with such a lead in the polls?

As a layperson it can be hard to quantify the uncertainty. First you have the inherent uncertainty of sampling voters and extrapolating sampled results to the population. Then you have uncertainty regarding pollsters’ methods and their accuracy. For example, in this election the polls turned out to be systematically biased against Trump, as if pollsters learned nothing from 2016. And then you have uncertainty of scandals and other events unfolding before the election takes place.

Luckily, problems like this have an easy answer: defer to an expert. It’s not always clear who’s an expert in a particular area, especially when people who are touted as experts often fail catastrophically in their supposed field of expertise. But sometimes you can trust a person. In this story our deferred expert opinion comes from Nate Silver. Silver has a good track record on political predictions[***] and his Bayesian approach to predicting is sound (I had read his book several years ago).

So how did Silver quantify Trump’s chances?

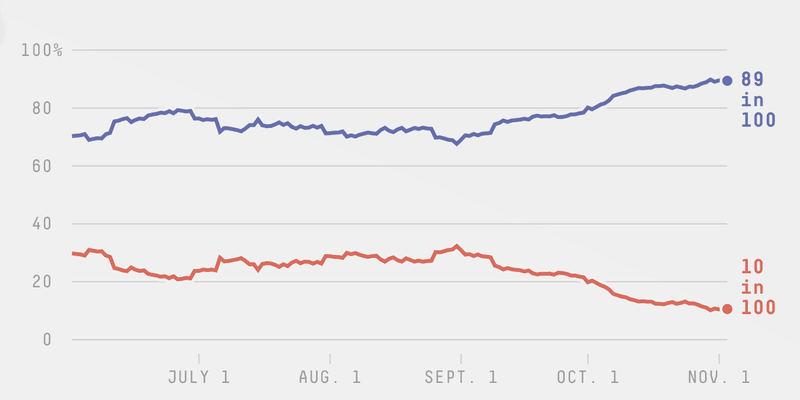

Two weeks before the election, on 19.10., Silver was predicting 88% chance of victory for Biden. At the same time Unibet was offering odds of 1.58, implying only 63% chance. If you took Silver’s estimate as granted, then the expected value for betting on Biden would be +39% of your stake. For example, if you bet $1000, then your expected value would be $390. Or another way of looking at it is: how wrong would Nate Silver have to be in order for this bet to have negative expected value? Silver’s 88% chance of victory implies that fair odds should be around 1.14, compared to actual odds of 1.58. That’s insane. Nate Silver might be wrong, but he can’t be this wrong. That day I made my first political bet ever (and I should mention, I don’t really do any other kind of betting either - this was just too good of an opportunity to miss).

I didn’t intend to bet more on this event. Over the next few weeks Biden’s odds fell lower (as you might expect, given no significant news events, there is less uncertainty closer to the election). But then, on the very last day before the election, Biden’s odds jumped to 1.60. At the time Silver was predicting 90% chance of a Biden victory, and there was only one day left, so there wasn’t much room for any surprises to come up. Suddenly, the betting opportunity of the decade got even better. So I decided to bet again and double my exposure.

The counting of the votes

The day before the election it was widely speculated that Trump would gain an early lead when vote counting begins, and that Biden would catch up once more of the mail-in votes were counted. This was speculated due to democrat voters’ historical preference for mail-in voting over in-person voting, and the fact that vote counting begins from in-person votes. Even late night tv show hosts talked about this.

Then the thing happened that everybody said was going to happen: they started counting in-person votes and Trump had a significant early lead. Faced with this entirely anticipated event, you would expect a muffled reaction from the market. But it’s 2020 and nothing makes sense anymore, so market reaction was anything but muffled: Biden’s odds shot through the roof. In the early hours of vote counting, when I was soundly asleep, you could place bets for Biden with odds above 5.0 (implying less than 20% of chance of winning).

I thought betting for Biden with 1.6 odds was the betting opportunity of the decade, but it turned out the real opportunity was available in live betting as the event was unfolding. Reminder to self: next time there’s a huge betting event, reserve some ammunition for live bets and follow the event as it’s unfolding, just in case something insane happens.

Anyway, the votes were counted and Joe Biden was declared as the winner by most media outlets. The race turned out to be much closer than anticipated in several swing states, but Biden’s lead in the polls was so large that he could withstand a larger-than-normal sized polling error and still win.

Sure, the results weren’t official yet. Trump could still overturn these results by uncovering fraud, exploiting a technicality, or perhaps by discovering a hidden stash of votes that should have been counted but weren’t. However, he would have to overturn results in multiple states in order to win enough electors. Despite the legal prowess unleashed at Four Seasons Total Landscaping, overturning results didn’t seem like a realistic outcome. So most betting sites decided to settle bets at this point.

The story is supposed to end here, but it doesn’t

Although most betting sites did settle bets once the votes were tallied, some didn’t. In particular, Betfair decided to keep the market open. This was especially strange, because Betfair’s terms clearly specified that the winner will be declared based on ”projected elector count”. The actual elector count was described as a ”subsequent event” which has no bearing on the bets. In fact, an earlier version of Betfair’s terms went even further and specified that bets will be settled according to whoever CNN declares as the winner (they quietly removed this condition at some point, despite having already matched bets on those terms).

Imagine this: you bet money for Biden on Unibet. Biden is declared to be the winner of the election by multiple media outlets. Unibet settles the bet and pays out your winnings. What should you do with your hard-earned money? Grab some ice cream? Go shopping? Here’s an idea: deposit your winnings on Betfair and bet on Biden again. That’s right, bet again on the same event that was already once settled in your favor. Apparently, that’s a thing you can do. So… that’s exactly what I did.

You might be thinking: even if the market remains open, there’s no way anybody would be willing to take the other side of those bets, except maybe at 1.01 or something. Nope… for a whole month after the votes were counted, you could bet for Biden on Betfair between 1.03 and 1.10 (I placed bets at 1.05).

First I thought 1.6 odds before the event was the betting opportunity of the decade. Then the event began to unfold and I thought, man, the real opportunity turned out to be live betting during the event. So there was some opportunity before the event, and some opportunity during the event, sure. But never in a million years would I have thought that an opportunity like this becomes available after the event. Who on earth was willing to lay (bet against) Biden at 1.05 after the votes were counted and after Trump’s lawsuits[****] were laughed out of court?

Betfair settled the bet yesterday, on 14.12. I usually make an effort to understand why things turned out the way they did, but I can’t figure this one out. I’m just gonna take my free lunch and go.

.

Clarifications:

[*] I’m using the term ”betting market” loosely. If you want a strictly theoretical argument, let’s say that the term refers specifically to Betfair exchange, where the market price is entirely determined by bettors, in a fashion similar to a stock market. However, in this election the odds set by traditional bookmakers also closely followed the odds in Betfair exchange (as they should, due to arbitrage opportunities). So a casual reader could imagine traditional bookmakers to fall under the ”betting markets” umbrella.

[**] Although a layperson will find it difficult to gain an edge in trading large stocks like Coca-Cola, they might still be able to gain an edge in trading stocks of small companies, because large investors are practically unable to invest in small companies, which leads to more inefficiencies in small companies’ stock prices.

[***] People keep bashing Silver for ”failing to predict” Trump’s 2016 victory. But if you had been making bets based on Silver’s predictions, you would have bet for Trump in 2016, and you would have won, because Silver’s probabilities for Trump in 2016 were higher than those implied by the betting markets. So, whatever significance you place on the outcome of a single prediction (personally, not much), Trump’s 2016 victory would be an example of a successful prediction by Silver, not an example of a failed prediction.

[****] I assume some lawsuits are still pending or upcoming, so perhaps not all lawsuits were laughed out of the courts in early December. So could you cling onto some kind of hope for a last minute Christmas miracle. If you’re into betting for miracles and that sort of thing.